Acquisition Strategy

Circle Industrial is focused on industrial real estate exclusively. Our core investment beliefs are to invest defensively, with an eye on functionality, optionality, and upside. As a defensive investor, we look to make certain that our downside in any investment is always limited. This can be accomplished by achieving a reasonable cost basis, having a diverse income stream, credit tenants with long term leases, tenants with significant investment in the asset, and/or flexibility with multiple exit strategies.Once we establish an asset as limited risk, we look for components of key functionality and location. In essence, would the property still be attractive in a tough economy with significant vacant competition and what are demand drivers for the location? Overall, Circle Industrial is focusing on value oriented investments – and we believe that our extensive experience in acquiring and operating industrial assets gives us a better perspective on where and how to invest when compared to most institutional and private investors.

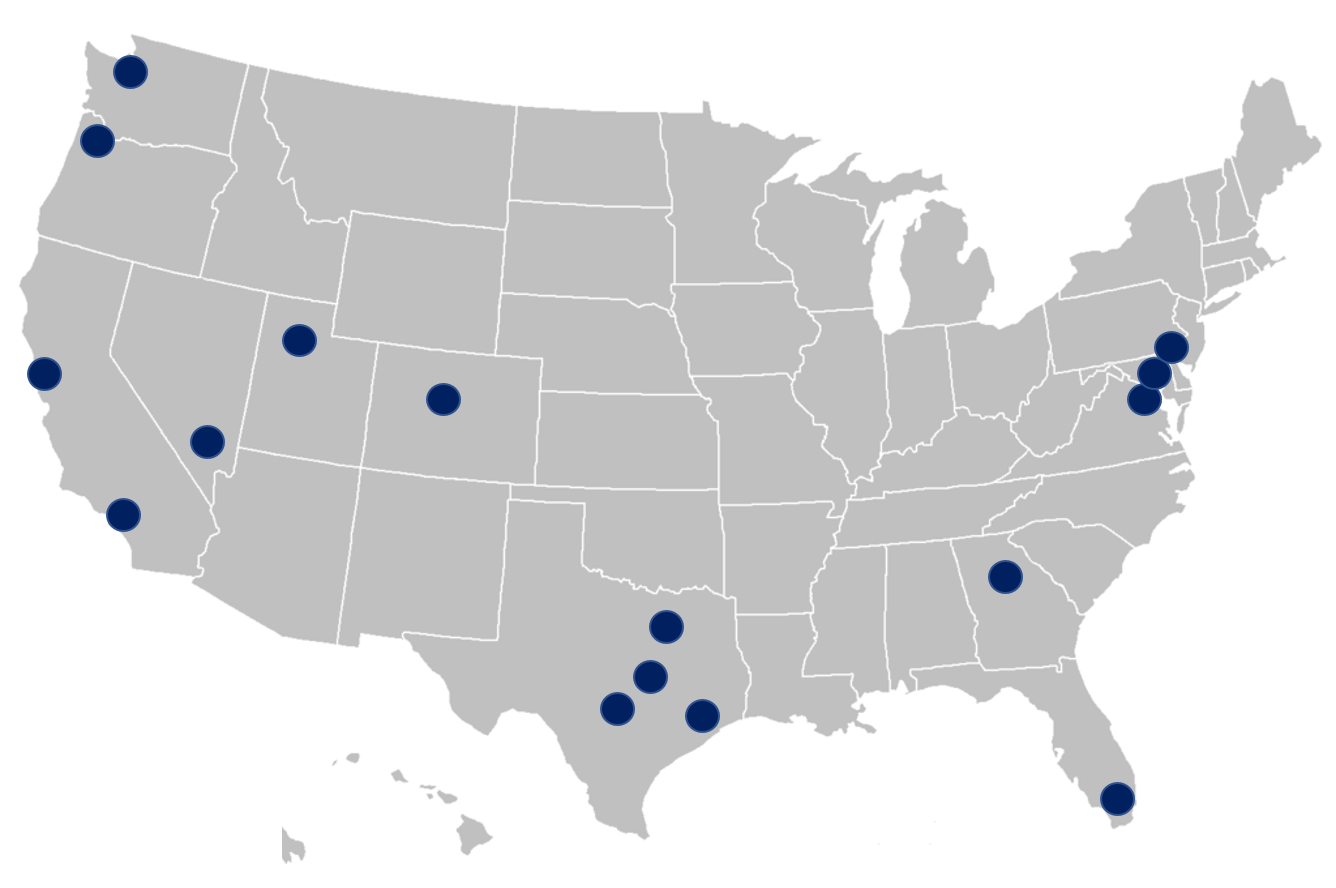

Target Markets

Circle pursues deals in high barrier to entry markets with high population densities and strategic logistics locations. We have a strong presence in Southern California, with a portfolio that includes properties from Texas to Delaware.

Circle is aggressively pursuing acquisitions in select markets across the U.S.

Circle has a proven track record of generating strong returns through a unique, tailored approach to each investment strategy.

Acquisition Criteria

Value-Add

- Multi-Tenant Projects with Stable Cash Flow and Rent Growth at discount to replacement cost

- Vacant Purchase with Refurbishment

- Covered land opportunities with multiple exit strategies

- Value through portfolio purchase and break-up of assets

Development

- Design and construction of highly functional Class A facilities

- Forward development purchase at discount to market

Core

- Acquisition of Modern Class A Facilities, preferably related to e-commerce

- Long Term Leased or Captive Tenant Opportunities